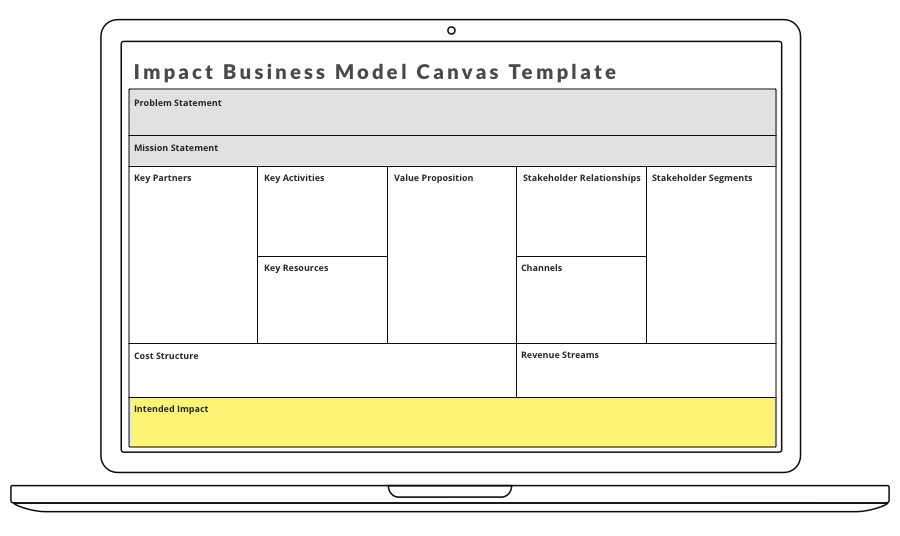

12 | Intended Impact

Intended Impact highlighted on the canvas

An impact statement is a statement or series of statements about what specifically the organization is trying to achieve and will hold itself accountable to. It succinctly identifies what results the organization will accomplish, for whom, and in what time frame, e.g., “We will serve X population in Y geography to accomplish Z outcomes by 20XX.” Of note, a theory of change provides a conceptual road map for how an organization expects to achieve its intended impact... [continued below]

Intended Impact:

Reach 100 million people in the developing world and improve four areas of well-being by 2020 (financial freedom, productivity gains, human health, environmental health).

d.light sells solar energy solutions to populations without electricity in 60+ nations. See project description and its Impact BMC

Intended Impact:

Closed enrollment gaps in America’s public schools by 2023

Equal Opportunity Schools helps minority and low-income high school students succeed in AP and IB courses. See project description and its Impact BMC

Measuring one’s impact is an important step in being able to communicate about it with impact customers. Once you have articulated a theory of change and operationalized it through a logic model, create an evaluation plan by identifying the set of measures that will help demonstrate progress toward your intended impact. What information do you want to collect? How will you create a baseline? What are the interim steps that demonstrate progress that you want to capture?

In deciding what to measure, consider that impact customers like to compare your positive impact as well as negative externalities with that presented by other organizations.

The Global Impact Investing Rating System (GIIRS) provides a comprehensive rating system for social and environmental impact, analogous to S&P credit risk ratings. GIIRS leverages the Impact Reporting and Investment Standards (IRIS) performance metrics to generate its ratings. IRIS is a catalog of terms and definitions that can be used to describe the social, environmental, and financial performance of an organization. Developed by the Rockefeller Foundation, Acumen Fund and B-Lab, it was launched in 2009 in conjunction with the Global Impact Investing Network (GIIN). IRIS provides standard terminology that has been agreed upon in the impact investing community so that the performance metrics can be transparent and comparable across ventures.