Security 8 - New EMV Cards

EMV cards are about to be rolled out massively in the US, so you heard it here first!

EMV Card - aka Chip Card

- EMV (Europay Mastercard Visa) have been in use in Europe for over 20 years (EMV on wikipedia)

- Known as "Chip and Pin" or "Chip and Signature" cards

- There are various attacks to nibble at EMV

- However EMV is much more secure than old mag-stripe

- The details are complicated, but the basics are simple

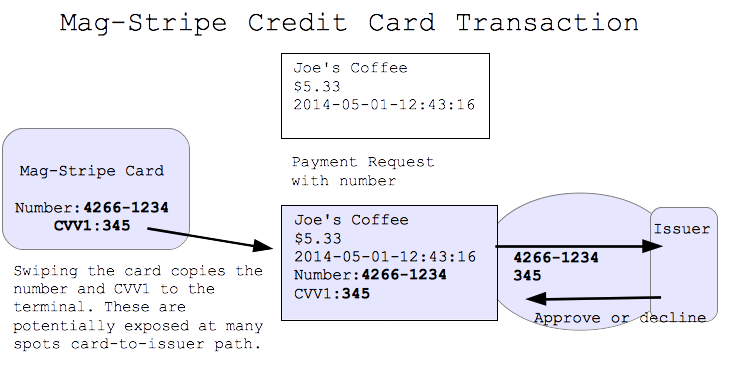

How Do Mag-Stripe Credit Cards Work?

- The old way - really quite insecure

- One "secret" is the Credit Card number, printed on the front of the card

- There's also a "CVV1" number on the mag stripe, not printed on the back

- Anyone who has these "secrets" can try making charges

- There is a different CVV2 number printed on the back

- Card-swipe: "secret" is the CC number + CVV1

Mag-Stripe Credit Cards Weaknesses

- Weakness: the "secret" can be stolen along the whole path

- Call this "skimming" .. many forms

- e.g. a. in the magstripe reader ("skimmer")

- e.g. b. in the POS (Point of Sale) device

- - Target POS breach, 40 million cards

- e.g. c. the waiter covertly swipes it to get the secret

- e.g. d. along the path to the issuing bank

- A "skimmer" bad guy device attached to ATM, steals "secret"

- e.g. Krebs Skimmer Example

- Conclusion: sending the "secret" unencrypted is a terrible system

- There are many places the bad guys can get to it

EMV Chip on Card

- There's a chip on the card

- The chip has a secret "key" on it, coded at the bank

- EMV uses keys and encryption (below)

- Important strategy improvement: the secret key never leaves the chip

- If the retailer's equipment is compromised .. we're still fine!

How EMV Works

- Insert the card chip-side up into the terminal

- Leave the card inserted, so it can communicate

- Merchant creates a payment request, sends it into the card

- The chip in the card creates with its secret an encrypted "blob" request

- -e.g. imagine the card encrypts the request with the secret key

- Merchant sends the encrypted blob to the issuer to request payment

- The issuer has a copy of the secret to decrypt the request

- Key improvement: Encrypted blob is useless to the bad guys if intercepted

- The secret never leaves the chip

- The secret is what one needs to make encrypted blobs

- Avoid needing 100% security along the card-to-issuer path

- I estimate EMV is about 100x more secure than mag-stripe for this "swipe" case

- The request includes the CC number but not the needed CVV1

EMV - Contactless

- The little wireless-pay terminals

- There are based on EMV too

- Apple Pay, Google Pay, etc.

- Retain the key feature: data interception is harmless

EMV Card Shift

- Mag stripe: anyone holding the card can get the info off it

- -Bad guy makes a duplicate card, goes to Best Buy etc.

- EMV: only the chip in the card can make a valid request

- -Having the card briefly does not allow one to make a duplicate

- Therefore: the bad guys must steal the physical card

EMV Weakness 1 - Card Stolen

- Now the physical card itself is vital

- Bad guy could steal it from your wallet, go use it

- Some EMV cards require a PIN, guarding against the card-stolen case

- In the US, issuers are choosing to not do PIN

- My guess: skimming was a big problem, card-stolen is relatively rare

- US issuers may add PIN back, once people are used to EMV

EMV Weakness 2 - On The Internet

- Typing your CC number on a web site is CNP (Card Not Present)

- CNP is not getting the benefit of the EMV chip

- When Europe introduced EMV, CNP fraud went up!

- Like there's a pool of bad guys, and the need something to do

- There's possible solutions, but no great solution yet

- Maybe cell phones will supplant cards eventually

- Basic agency problem: the merchants eat the loss for CNP fraud

- -But the issuers control the tech .. lack motivation

- The issuers eat the fraud for "skimming" fraud

EMV Summary

- This is going to be a big improvement

- Makes the skimming (Target) case disappear

- There are weaknesses, but not fatal ones

- We might see PIN get rolled out in the USA eventually

- Next we need to solve the CNP "internet" case