Contents

function h = finance

Problem data

s = RandStream.create('mt19937ar','seed',0);

RandStream.setDefaultStream(s);

n = 20;

T = 15;

F = randn(n);

S = F*F';

d = abs(randn(n,1));

gam = 1;

mu = randn(n,1);

kappa = unifrnd(0,3,n,1);

f = @(u) -mu'*u + (gam/2)*quad_form(u,S);

g = @(u) kappa'*pow_pos(abs(u), 1.5);

CVX (static)

tic

cvx_begin quiet

variable xs(n)

minimize(f(xs))

subject to

sum(xs) <= 1

xs >= 0

cvx_end

h.xs = xs;

toc

Elapsed time is 0.095368 seconds.

CVX (dynamic)

tic

cvx_begin quiet

cvx_solver sdpt3

variable x(n,T)

expression obj

obj = f(x(:,1));

for t = 2:T

obj = obj + f(x(:,t)) + g(x(:,t) - x(:,t-1));

end

minimize(obj)

subject to

sum(x) <= 1

x >= 0

x(:,1) == 0;

x(:,T) == 0;

cvx_end

toc

p_cvx = cvx_optval;

Elapsed time is 2.230762 seconds.

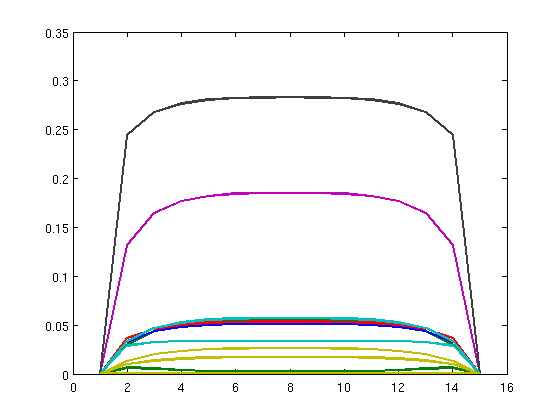

Plots

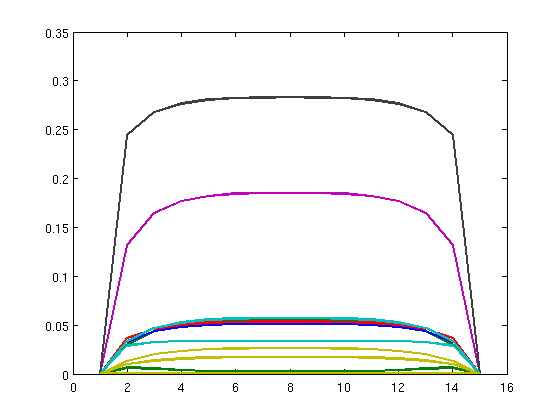

figure(1);

plot(x', 'LineWidth', 2);

xlim([0 T+1]);

print -depsc fin_asset_holdings.eps;

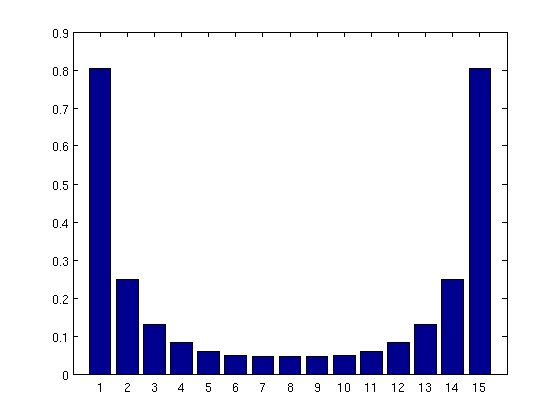

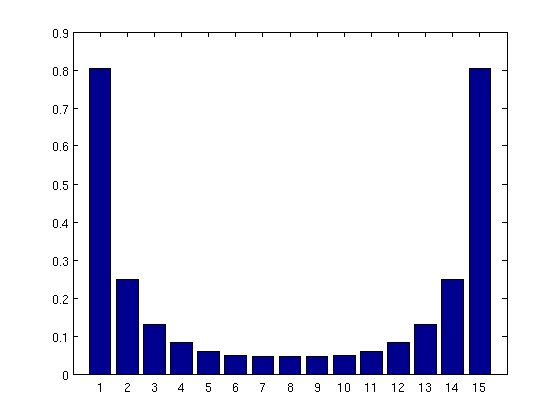

figure(2);

bar(norms(x - repmat(xs,1,T), 1));

xlim([0 T+1]);

print -depsc fin_deviation.eps;

ADMM

MAX_ITER = 100;

ABSTOL = 1e-4;

RELTOL = 1e-2;

lambda = 1;

x = zeros(n,T);

z = zeros(n,T);

u = zeros(n,T);

fprintf('\n\n%3s\t%10s\t%10s\t%10s\t%10s\n', 'iter', ...

'r norm', 'eps pri', 's norm', 'eps dual');

for k = 1:MAX_ITER

for t = 2:T-1

cvx_begin quiet

variable xt(n)

minimize(f(xt) + (1/(2*lambda))*sum_square(xt - z(:,t) + u(:,t)))

subject to

xt >= 0

sum(xt) <= 1

cvx_end

x(:,t) = xt;

end

zold = z;

cvx_begin quiet

cvx_solver sdpt3

variable z(n,T)

obj = 0;

for t = 2:T

obj = obj + g(z(:,t)-z(:,t-1));

end

minimize(obj + (1/(2*lambda))*square_pos(norm(z - x - u,'fro')))

subject to

z(:,1) == 0;

cvx_end

u = u + x - z;

h.r_norm(k) = norm(x - z,'fro');

h.s_norm(k) = norm(-(z - zold)./lambda,'fro');

h.eps_pri(k) = sqrt(n*T)*ABSTOL + RELTOL*max(norm(x,'fro'), norm(-z,'fro'));

h.eps_dual(k) = sqrt(n*T)*ABSTOL + RELTOL*norm(u./lambda,'fro');

h.objval(k) = f(x(:,1));

for t = 2:T

h.objval(k) = h.objval(k) + f(x(:,t)) + g(x(:,t) - x(:,t-1));

end

fprintf('%3d\t%10.4f\t%10.4f\t%10.4f\t%10.4f\n', k, ...

h.r_norm(k), h.eps_pri(k), h.s_norm(k), h.eps_dual(k));

if h.r_norm(k) < h.eps_pri(k) && h.s_norm(k) < h.eps_dual(k)

break;

end

end

h.admm_iter = k;

h.x_admm = x;

h.mu = mu;

iter r norm eps pri s norm eps dual

1 0.2739 0.0122 0.9409 0.0045

2 0.2108 0.0138 0.2525 0.0065

3 0.1744 0.0142 0.0813 0.0081

4 0.1455 0.0143 0.0398 0.0094

5 0.1223 0.0143 0.0273 0.0105

6 0.1039 0.0142 0.0210 0.0114

7 0.0892 0.0142 0.0167 0.0122

8 0.0775 0.0142 0.0134 0.0129

9 0.0680 0.0141 0.0108 0.0135

10 0.0604 0.0141 0.0088 0.0140

11 0.0541 0.0141 0.0072 0.0144

12 0.0487 0.0141 0.0060 0.0148

13 0.0442 0.0141 0.0051 0.0151

14 0.0402 0.0141 0.0043 0.0155

15 0.0367 0.0141 0.0037 0.0157

16 0.0336 0.0141 0.0032 0.0160

17 0.0309 0.0141 0.0028 0.0162

18 0.0284 0.0141 0.0025 0.0164

19 0.0261 0.0140 0.0022 0.0166

20 0.0241 0.0140 0.0020 0.0168

21 0.0222 0.0140 0.0018 0.0169

22 0.0205 0.0140 0.0016 0.0171

23 0.0190 0.0140 0.0015 0.0172

24 0.0176 0.0140 0.0013 0.0173

25 0.0163 0.0140 0.0012 0.0174

26 0.0151 0.0140 0.0011 0.0175

27 0.0140 0.0140 0.0010 0.0176

Plots

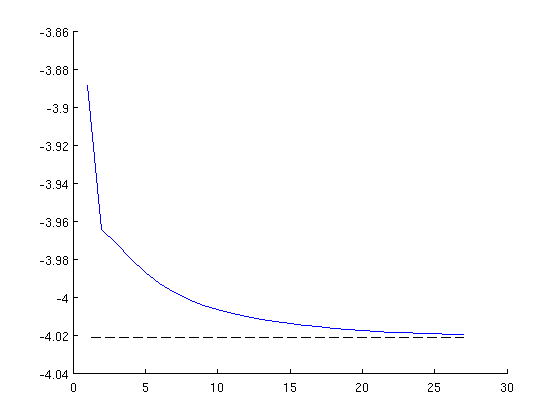

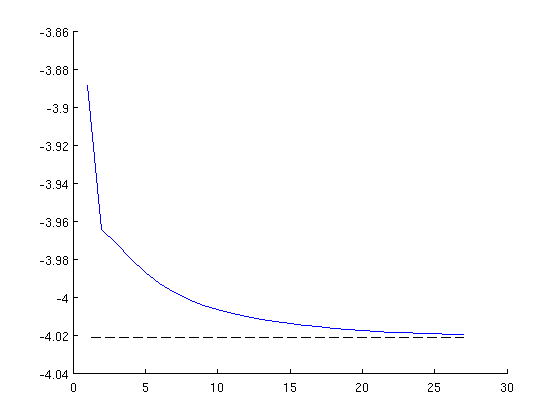

figure(3);

hold on;

plot(h.objval');

plot(repmat(p_cvx, 1, k), 'k--');

print -depsc fin_optval.eps;